Sustainability as a freelancer is something I don't think gets enough attention. It's not flashy and for sure doesn't make for a good Instagram post. Still, to stick around you've got to try and figure out what works for you and your situation.

If you know me at all, you'll know I'm always up to talk about money. Not in the "Hey plebeian! Look what I've got!" way but more in the mindset of "You're in this hot mess too?! What are you doing?! Is it working? Is there a way we can learn from each other?"

The last few weeks have been a welcomed whirlwind. I've broken record'd the battle cry of "Oh man, I'm so busy" and I'm absolutely aware of it. What's freakin' awesome though is the fact that money is coming through the doors and for that, I'm insanely thankful. Freelance is "feast or famine" and I know the financial spigot could shut off for a season at any point.

Turns out it's expensive AF to be a freelancer, especially as you get further into your career. The amount of overhead I've accumulated over the years running this freelance operation is DUMB. Thinking back to when this whole thing started as a side hustle back in 2004-ish I'd have never imagined the amount of money it takes to keep this up plus trying to be intentional about the future.

At times it feels like I'm working just to keep up: production insurance, health insurance for me and our two boys, plus life and disability insurance. Then there's the money set aside for taxes and retirement accounts. Oh, then there's paying off bank loans, paying myself every two weeks, phone and internet bills, and on and on and on. It's dumb.

Positive side note: I paid off my car today – several months early BTW – so that's rad.

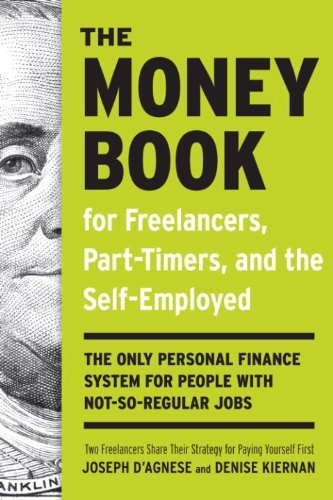

The biggest leg up I've had in terms of money management as a freelancer has come from a book I read back in 2010-11-ish – The Money Book for Freelancers, Part-Timers, and the Self-Employed.

Here are some of my biggest takeaways from the book:

"If you’re trying to create financial security as an independent worker, but you are following guidelines that are designed for traditional workers, you’re going to get yourself into trouble."

"They [percentages] are the best - and really only - way to save consistently based on what you actually earn, especially when what you earn varies widely and doesn’t arrive on a predictable schedule."

This was the biggest thing for me. As a former full-time employee, I was used to working on a very specific budget with close to exact numbers. Unlike my wife's very reliable paycheck each month, there's no way to know the specific amount that my freelance work will be bringing in each month. I've already written about using past records to help me predict my busy and slow seasons, but that's still just an educated guess. In planning ahead financially, I stick with setting aside 15% of my profits to pay my taxes as well as 10% to put towards retirement. I've been slowly and steadily stashing money into a RothIRA since I was 21 as well as another RothIRA under my wife's name as I max out the first one each year.

"If you don’t pay yourself first, you probably won’t do it at all."

"Debt is by far the biggest threat to both your career and your stability and stands between you and your success."

"Debt is sucking the money from your present to pay for your past at the expense of your future."

"If you don't save for your retirement, no one else will."

"Being an independent worker means you have to save more, plain and simple."